Your Guide to the Lasting Power of Attorney (LPA)

Many people are familiar with a will – it contains instructions to their loved ones on managing their affairs upon death.

But what happens in the event when you lose mental capacity, and cannot make decisions nor manage your affairs by yourself?

You risk having your financial assets frozen, since your loved ones cannot access them without your consent. Various institutions may not recognise decisions that your loved ones make for you, causing them unnecessary frustration and hardship.

To act for you and manage your affairs, your loved ones will have to apply to become your deputy through the courts - an expensive and tedious process. Furthermore, you have no say in who becomes your deputy.

Are there other alternatives for you and your loved ones?

This is where the Lasting Power of Attorney (LPA) comes in.

- Understanding the Lasting Power of Attorney (LPA)

- Why Should You Create an LPA

- What to Consider When Creating a Lasting Power of Attorney

- What Should You Do Now?

Understanding the Lasting Power of Attorney (LPA)

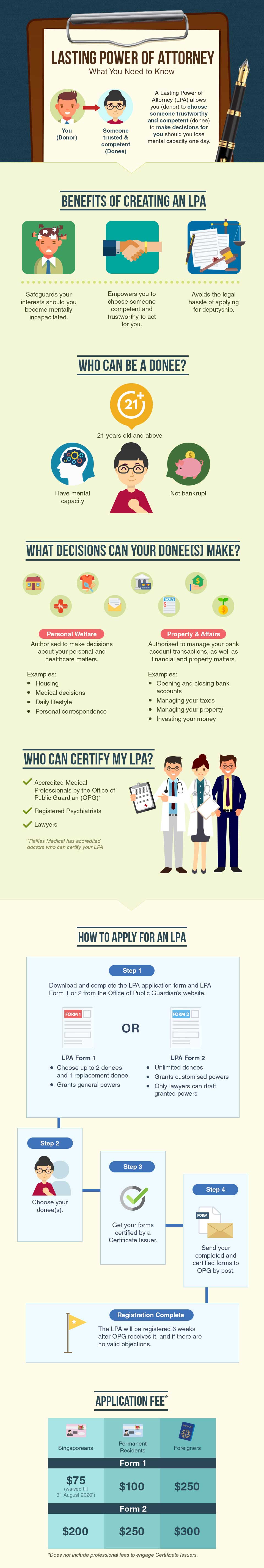

Broadly speaking, an LPA is a legal document which allows a person (donor) who is at least 21 years old to appoint one or more persons (donees) to make decisions and act on his behalf should he lose mental capacity.

The LPA comes under the Mental Capacity Act, which covers a wide range of decisions made for, and actions taken on behalf of a person lacking mental capacity. This includes decisions about day-to-day matters, such as what to eat and wear, as well as major decisions such as moving house and undergoing surgery. The Act does not legalise nor provide for euthanasia.

Why Should You Create an LPA?

Creating an LPA has multiple benefits. You can choose who will act on your behalf should you lose mental capacity. They can manage your affairs for you immediately without going through the courts to apply for deputyship. Compared to creating an LPA, the process of becoming a deputy is more tedious and costly.

“Think of creating an LPA as part of your life planning. With one in place, you enjoy peace of mind knowing your loved ones can immediately act on your behalf to protect your interests should you lose mental capacity,” said Dr Wong Wei Mon, Senior Family Physician, Raffles Medical. “The LPA also grants your loved ones access to your finances, which they can use to pay for your daily and medical expenses, reducing any hardship placed on them.”

What to Consider When Creating a Lasting Power of Attorney

Which LPA Form to Choose

You can choose between two forms when creating an LPA: LPA Form 1 or LPA Form 2. Your choice will depend on your needs.

LPA Form 1 vs Form 2

| LPA Form 1 (For Standard Needs) |

LPA Form 2 (For Complex Needs) |

|

| Powers Granted | Grants a broad range of powers with basic restrictions to your donee(s) to fully act in your best interests, subjected to the Mental Capacity Act. | Powers granted to donee(s) are customisable, subjected to the Mental Capacity Act.

Only lawyers can draft the powers granted to your donee(s) |

| Who Can Witness and Certify | Accredited medical professionals, registered psychiatrists, and lawyers. | Lawyers only. |

| Number of Donees | Up to two donees, and one replacement donee. | No limit. |

| Application Fee to OPG | $75 for Singaporeans. (Waived till 31 August 2020, excludes professional fees from Certificate Issuers)

Source: Office of Public Guardian |

$200 for Singaporeans. (Excludes professional fees from Certificate Issuers) |

According to the Office of Public Guardian (OPG), 98% of Singaporeans who have created an LPA use the LPA Form 1.

Number of Donees Appointed

You are required to appoint at least a donee who is 21 years old and above, and not an undischarged bankrupt. Make sure your donee(s) is trustworthy and competent enough to act in your best interests, as well as willing to take on the responsibility of doing so.

Decisions Your Donee(s) Can Make

Your donee(s) can act in two broad areas:

- Personal Welfare. This includes your day-to-day needs, such as where you stay, your lifestyle, whom you have contact with, and your care.

- Property and Affairs. This includes decisions related to your personal finances, managing your bank account(s), property, and other assets.

You can specify if your donee(s) can make decisions in either or both areas.

Scope of Powers Granted to Donee(s)

If you have more than one donee and have empowered them to make decisions on the same areas, you can indicate how the decisions are made:

- Jointly and severally. Your donees can either act on their own, or together. For instance, if you are hospitalised and the doctor can only get in touch with one of your donees, that donee can make a decision about your care without the other being in agreement.

- Jointly. Your donees need to come to all decisions unanimously. Using the above example, the donee whom the doctor contacted cannot make any decisions about your care, because all donees need to agree on the decision being made.

The law will assume your donees will act jointly if you did not indicate your preference.

Any Replacement Donees

If your donee(s) are unable to act for you for reasons stated in the Mental Capacity Act, the replacement donee(s) can immediately take over his or her duties. If you are using the LPA Form 1, you will only be able to appoint one replacement donee.

You should discuss these arrangements with your donee(s) and your loved ones, so everyone is aware of your donee(s)’ responsibilities, and they can work together to protect your interests should you lose mental capacity.

Selecting a Certificate Issuer for Your LPA

Depending on the LPA form chosen, you can select from one of the following to be your LPA Certificate Issuer:

- Accredited medical professionals

- Registered psychiatrists

- Lawyers

If you’re unsure of which Certificate Issuer to engage, here’s a quick guide to help you decide:

| Which Certificate Issuer to Choose | When to Engage | Which Form They Can Witness and Certify |

| Accredited Medical Professionals (e.g. general practitioners) | Suitable for those who fully understand the risks and obligations of creating an LPA and have no legal questions. Raffles Medical has accredited doctors who can certify your LPA.

Note: The medical professional will not be able to provide legal advice. |

LPA Form 1 |

| Registered Psychiatrists | Suitable for those with fluctuating mental capacity, possible or diagnosed mental health issues, or in the early stage of dementia.

In the situation where someone challenges that you lacked the mental capacity to create an LPA, a psychiatrist can ascertain your mental capacity at the point when you signed it. Note: The psychiatrist will not be able to provide legal advice. |

|

| Lawyers | Suitable for those who need legal advice about creating an LPA, or wish to grant customised powers to their donee(s). | LPA Forms 1 and 2 |

The professional fees for the engaging the Certificate Issuers will differ. Generally, the more complex your instructions and needs are, the higher the cost of engaging the Certificate Issuer.

What Should You Do Now?

You may already be starting to plan for your retirement. You should also do the same for your future care. According to the Alzheimer’s Disease Association, the number of people aged 65 and above is expected to reach 53,000 by 2020. The number is expected to increase to 187,000 by 2050.

Likewise, life is unpredictable. We don't know when an accident may befall us, robbing us of our mental capacity.

It's never too early to start putting safeguards in place for any mishaps or illnesses that may take away your mental capacity. Creating a LPA is relatively hassle-free. You will also be assured that someone you trust can immediately manage your affairs and make decisions on your behalf.

Reviewed by:

Dr Wong Wei Mon, Senior Family Physician, Raffles Medical

Dr Joshua Kua, Specialist in Psychiatry & Consultant, Raffles Counselling Centre